More than $200 billion were wiped off the entire cryptocurrency market this week, a report by Nishant Arora

As foreign portfolio investors continue to pull out money from the Indian equity market, the sell-off in the crypto market and the digital asset space has also accelerated in the wake of global economic meltdown.

More than $200 billion were wiped off the entire cryptocurrency market this week and the globally crypto market capitalisation fell below $1 trillion for the first time since February 2021, according to data from CoinMarketCap.

The already sinking cryptocurrency market in India is also witnessing a huge sell-off as the prices of Bitcoin and other cryptocurrencies nosedive amid volatile market conditions triggered by factors like high inflation, rising interest rates, the Russia-Ukraine war, and China lockdowns.

According to experts, crypto investors and traders in India are currently exercising caution and a distinct dip in crypto buying has been noticed.

Nischal Shetty, co-founder of cryptocurrency exchange WazirX, said: “Indian investors are cautious and are taking the ‘wait and watch’ approach.”

Bitcoin (BTC), the world’s largest cryptocurrency, has plunged about 70 per cent since its record high of $69,000 in November last year.

It was hovering around Rs 20,000-Rs 21,000 per coin this week.

According to analysts, Bitcoin may hit a grim $14,000 this year at this rate.

Smaller cryptocurrencies, which tend to move in tandem with Bitcoin, also fell.

Ethererum, the second-largest digital token, fell as much as 12 per cent to $1,045, a new 15-month low.

The current decline means that Ethererum has shed 77 per cent of its value since November 2021.

According to Cointelegraph, Ethereum sell-off resumed this week, with its price risking another 25 per cent decline in June.

However, in such a gloomy scenario, India’s own Gari digital token by short-video making app Chingari has risen about 40 per cent.

Chingari, the fastest-growing Blockchain social app, this week announced the ‘GARI Mining’ programme to empower 4 crore monthly average users (MAU), becoming the first social app in the world to offer crypto to its creators and users on its platform.

“This programme will ensure a level playing field for big and humble creators. Now, creators and users on the app can earn GARI tokens which can be traded on exchanges for money and creators will not be at the mercy of brand collaborations as their only source of income,” said Sumit Ghosh, Co-founder and CEO, Chingari and GARI token.

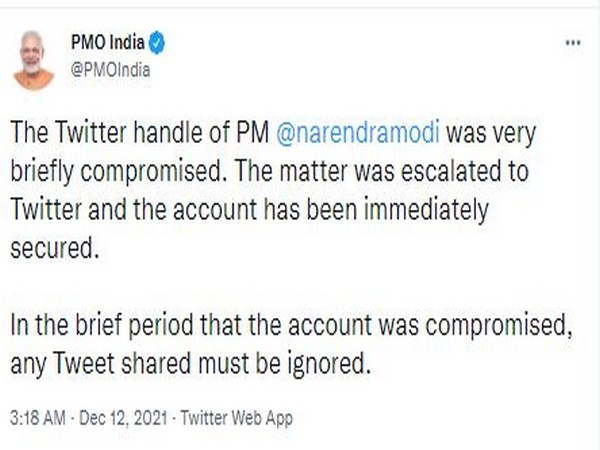

Meanwhile, the fate of cryptocurrencies in India is still hanging in balance, and the much-awaited crypto bill is yet to see the light of the day.

In April, Finance Minister Nirmala Sitharaman reiterated her doubts about the size of the cryptocurrency market worldwide and stressed the need for a regulatory mechanism acceptable to all countries to prevent its use to launder money and fund terrorism, which, she said, were big concerns for India.

India distinguishes between cryptocurrency and crypto assets as a result, and the minister had in February announced a 30 per cent tax on income from these transactions, which includes a 1 per cent deduction at source.

The country is poised to have its own digital currency by the Reserve Bank of India (RBI) next year that will be based on Blockchain technology.

According to Sathvik Vishwanath, Co-founder and CEO, Unocoin, “the cryptocurrencies industry is fast evolving and hence it would need regulations to be constantly updated”.

“It is unlikely to be successful if we just try to bring guidelines for cryptos,” he said.

Not only cryptocurrencies, investors of DeFi (decentralised finance) platforms also need to exercise “caution and scrutiny” amid growing concerns about the liquidity of this certain type of cryptocurrency service, experts have warned.

The warning came as Celsius Network, a DeFi platform and one of the largest crypto lenders, announced that it was “pausing all withdrawals, Swap, and transfers between accounts” for its 1.7 million clients.

“The wider crypto ecosystem has been rocked again — not by ‘real’ cryptocurrencies like Bitcoin, but by DeFi,” said Nigel Green, CEO of deVere Group, one of the world’s largest independent financial advisories.

“There are legitimate and serious concerns about networks’ high yields, links to failed dollar-pegged stablecoin Terra, and reserves,” said Green, urging people to exercise caution and scrutiny on crypto lending firms which offer clients lucrative double-digit yields on assets like Bitcoin and Ethereum.

Decentralised finance or DeFi offers financial instruments without relying on intermediaries such as brokerages, exchanges, or banks by using smart contracts on a Blockchain.

ALSO READ: Bill Gates slams crypto, NFTs