Despite increasing headwinds, Outbound shipment of iron and steel, machinery and equipment could top the chart as the EU has started to scout for new markets.

India’s exports to Europe are expected to rise in the short to medium term after the latter’s trade with Russia is in question following Moscow’s invasion of Ukraine. Despite increasing headwinds, Outbound shipment of iron and steel, machinery and equipment could top the chart as the EU has started to scout for new markets.

Until February this year, Russia was one of the main trade partners of the European Union. In 2021, Moscow was the EU’s fifth largest trade partner, representing 5.8 per cent of the region’s total trade in goods with the world.

Besides oil and gas, EU’s imports from Russia comprised wood, iron and steel, fertiliser, machinery and equipment, motor vehicles, pearl, and precious stones among other items.

“For Indian exporters, opportunities could further open up. With sanctions against Russia post its Ukraine invasion, Europe is already facing a crisis like situation..though the continent’s imports from Russia has not come to a halt, EU will eventually look for newer markets for non energy products,” Ajay Sahai, director general and CEO, Federation of Indian Export Organisations (FIEO) told India Narrative.

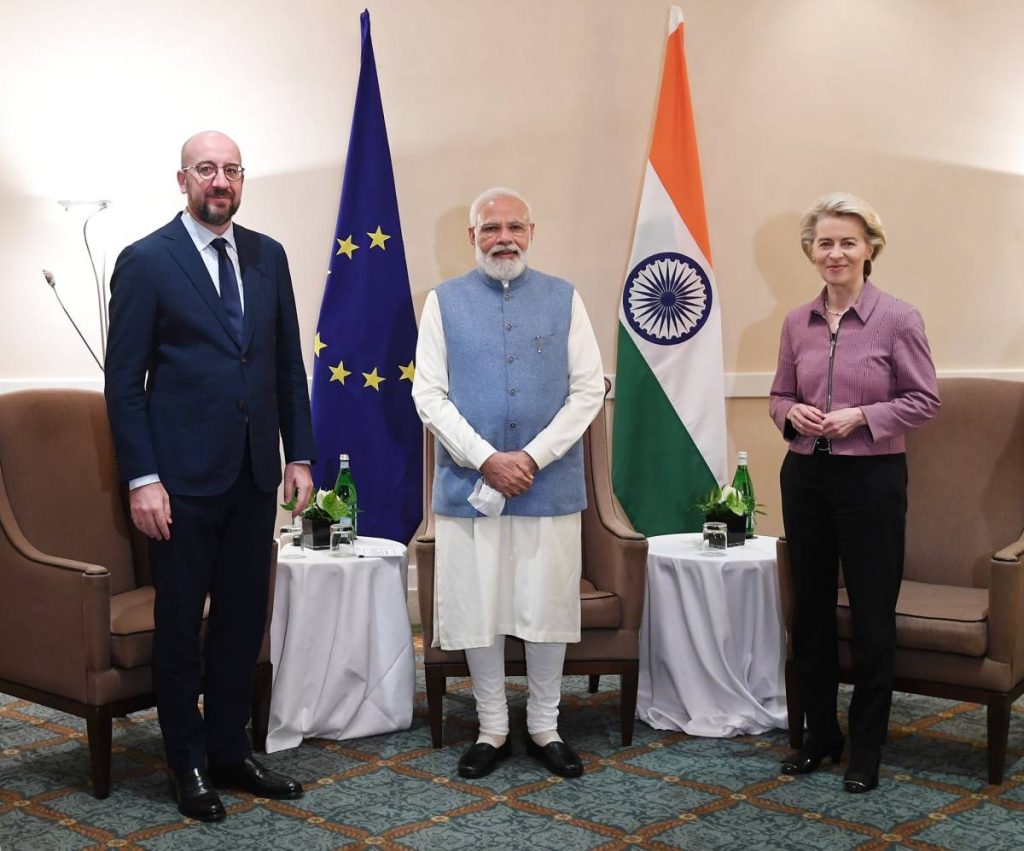

The EU is already India’s second largest trading partner after the US. Talks for a free trade agreement between India and the EU have also been revived this year. The negotiations were kicked off in 2007 but were suspended in 2013.

India’s bilateral trade with the EU amounted to $116.36 billion in 2021-22 — a growth of 43.5 per cent despite uncertainty in the global economic scenario.

While India’s exports during the April-September period increased by 15.54 per cent to touch $229.05 billion, global uncertainties have also had an impact. In September, the country’s outbound shipment stood at $32.62 billion in September against $33.81 billion in the same month last year. Trade deficit also widened to $26.72 billion, according to preliminary official data.

The strengthening of the US dollar — the American currency is at its highest level since 2000 — has led to tumbling of most currencies of the world. To contain domestic inflation, the US Federal Reserve has been hiking interest rates.

The dollar has appreciated 13 per cent against the Euro. Against the emerging market economies, it has risen 6 per cent since the start of this year. A sharp strengthening of the dollar in a matter of months has sizable macroeconomic implications for almost all countries, given the dominance of the dollar in international trade and finance, a blog jointly written by International Monetary Fund’s First Deputy Managing Director Gita Gopinath and Economic Counsellor and Director of Research Pierre-Olivier Gourinchas pointed out.

“Countries must preserve vital foreign reserves to deal with potentially worse outflows and turmoil in the future. Those that are able should reinstate swap lines with advanced-economy central banks,” the blog read.

(The content is being carried under an arrangement with indianarrative.com)

ALSO READ: EU steps up measures to combat soaring energy prices