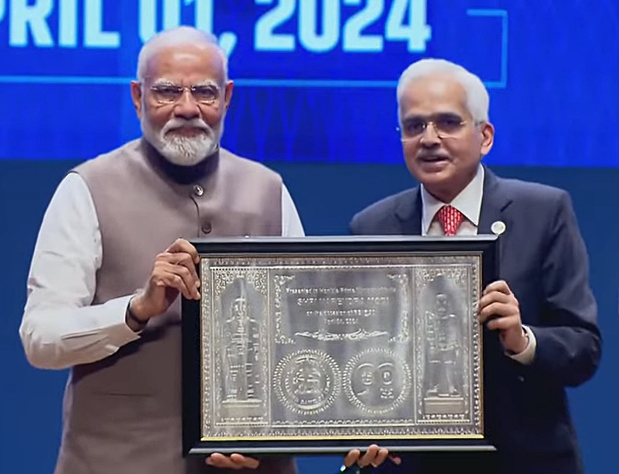

In the last 10 years, ever since Prime Minister Narendra Modi launched the ‘Make in India’ programme, lakhs of new jobs have been created….reports Asian Lite News

As the government begins the exercise to create benchmarks for electronics component manufacturing, industry stakeholders on Monday said the move will contribute significantly to creating an ‘Atmanirbhar Bharat’ and building a robust supply chain to further ramp up exports.

The IT Ministry has asked various stakeholders for their viewpoints, in order to formulate a production-linked incentive (PLI) scheme for the electronics component sector.

The move, said experts, will cut original equipment manufacturers’ (OEMs) dependency on countries like China and Vietnam for procuring various components and sub-assemblies for their products.

“Optiemus Electronics Ltd is committed to work with the government for development of a complete electronics ecosystem in the country,” A. Gururaj, Managing Director, Optiemus Electronics, told IANS.

“We welcome the government’s proposal to expand the PLI scheme to electronic component manufacturing in the country which will contribute significantly to truly creating an Atmanirbhar Bharat,” Gururaj added.

The government’s move will also create thousands of direct and indirect jobs.

In the last 10 years, ever since Prime Minister Narendra Modi launched the ‘Make in India’ programme, lakhs of new jobs have been created.

In electronics manufacturing alone, nearly 12 lakh new jobs have been created as electronics manufacturing reached more than $100 billion.

Avneet Singh Marwah, CEO, Super Plastronics Private Limited (SPPL), told IANS that the move promises to foster domestic component manufacturing, a crucial step towards realising the ‘Make in India’ initiative.

“Currently, we heavily rely on outsourcing key electronic components from various countries. However, with the introduction of in-house manufacturing, we stand to gain two significant advantages: enhanced competitiveness through more competitive pricing and the bolstering of our supply chain infrastructure,” Marwah elaborated.

According to experts, the PLI scheme for electronics is, undeniably, a game changer.

“We have witnessed a major company inaugurate its semiconductor plant, with others swiftly following suit to fortify this burgeoning ecosystem,” they added.

Prabhu Ram, Head, Industry Intelligence Group at market intelligence firm CMR, told IANS that expanding the PLI scheme to electronic components manufacturing is a strategic move to address a critical bottleneck in India’s domestic electronics ecosystem – its dependence on foreign suppliers.

“By incentivising local production, the policy will aim to boost domestic manufacturing capabilities and, over time, create a more resilient end-to-end electronics value chain with robust upstream and downstream capabilities within the country,” Ram told IANS.

Chip Crunch Alert

As India aims to reach $300 billion electronics production by FY26, it will trigger demand for semiconductors worth $90-$100 billion, largely driven by domestic mobile manufacturing — an opportunity the country must tap.

The current electronics manufacturing at nearly $103 billion translates to a semiconductor requirement of $26-$31 billion, considering the industry average of 25 to 30 per cent of chip components in any electronics product’s bill of material (BOM).

“With the expected rise in electronics production ($300 billion by 2026), this number is set to rise substantially to $90-$100 billion,” according to the data by the India Cellular and Electronics Association (ICEA).

Mobile phone production contribution in the overall electronics manufacturing jumped from 10 per cent to a whopping 44 per cent in the span of the last seven years.

In FY23, the total import of integrated circuits (ICs) reached $16.14 billion (out of which $12 billion was only for mobile phones).

According to the ICEA, processor chips, which are advanced chips specifically for high-end phones, may require some time before India can produce them at a competitive level.

“However, there is a commercial viability in fabricating processor chips for entry-level smartphones in India. This could be a consideration for the new semiconductor fabs,” said the apex industry body.

The data showed that with a monthly output of around 1.5 million units (10-14 nm) of chipsets – assuming 15,000 wafers of 300mm at 70 per cent yield from a fab, and considering the number of dies per wafer to be 148 – the annual output could be approximately 18 million chipsets.

Therefore, the critical task before all the stakeholders is to translate the burgeoning semiconductors requirement into domestic production and reduce dependency on imports.

“This transition would boost domestic procurement and increase the viability of the semiconductor fabs in India,” said the ICEA.

Prime Minister Narendra Modi in March laid the foundation stone for three semiconductor projects worth Rs 1.25 lakh crore.

The first ‘Make in India’ chip is set to arrive in December this year from the Micron semiconductor plant in Gujarat.

ALSO READ: PhonePe Lights Up Nepal with UPI Wonders