Reliance Industries is now the only entity in Asia to have won this prestigious award four times (2006, 2015, 2018 and 2023)….reports Asian Lite News

Reliance Industries Limited has been conferred with the IFR Asia’s ‘Issuer of the Year’ award for 2023 for achieving most optimal pricing for super-sized funding deals while overcoming multiple market challenges.

International Financing Review (IFR) is the pre-eminent financial publication globally for fixed income, capital markets and investment banking news, analysis and commentary.

Reliance Industries is now the only entity in Asia to have won this prestigious award four times (2006, 2015, 2018 and 2023).

This award is also unique, as it is given to only one entity across equity and debt markets, as well as across sovereigns, financial institutions and corporate (both government and private).

Key highlights of RIL’s financing deals in 2023 that enabled it to win this award:

Reliance raised $7.5 bn in syndicated loans – this was the largest amount raised by any corporate in Asia Pacific and the syndication was achieved with largest ever group of 55 banks. This also happened to be the most widely syndicated Indian deal ever.

In the process, Reliance Jio Infocomm raised its first ever syndicated loan on the strength of its standalone financials without a guarantee from RIL. And even then, the pricing differential between RIL and Jio on the syndicated loans was only 10bps – indicating the coming of age for Jio in the international financial markets.

RIL’s Rs 20,000 crore 10-year INR bond issue was the largest ever by a non-financial corporate and was significantly oversubscribed. It achieved RIL’s lowest coupon, and the tightest spread for a rupee bond, just 40bp over the Indian government 10-year security, and better than many state government bonds.

In June, RIL signed a $2.45 bn refinancing comprising a $2.105 bn 4.25-year tranche and a $351 mn 5.25-year tranche. Finding demand from a diverse group of 34 lenders, Reliance also managed to reduce its all-in cost.

The IFR Asia article explains the challenging scenario for corporate fund raising in the year 2023 that Reliance navigated successfully.

“2023 was not an easy year to raise financing. High US dollar rates had finally fed through to Asia’s offshore loan market, causing the primary market to freeze up. Meanwhile, the US dollar bond market was volatile and the cost of funding was far higher than onshore.”

Additionally, India raised the withholding tax on external commercial borrowings from 5 per cent to 20 per cent in July 2023, effectively raising the cost of borrowing for corporates.

In addition to this, Reliance has also received several other prestigious awards this year for its fund raising initiatives, which include ‘Best Issuer – Corporates’ award from Finance Asia and ‘Best Syndicated Loan – Conglomerate’ award from The Asset.

Ambani Tops Brand Index 2024

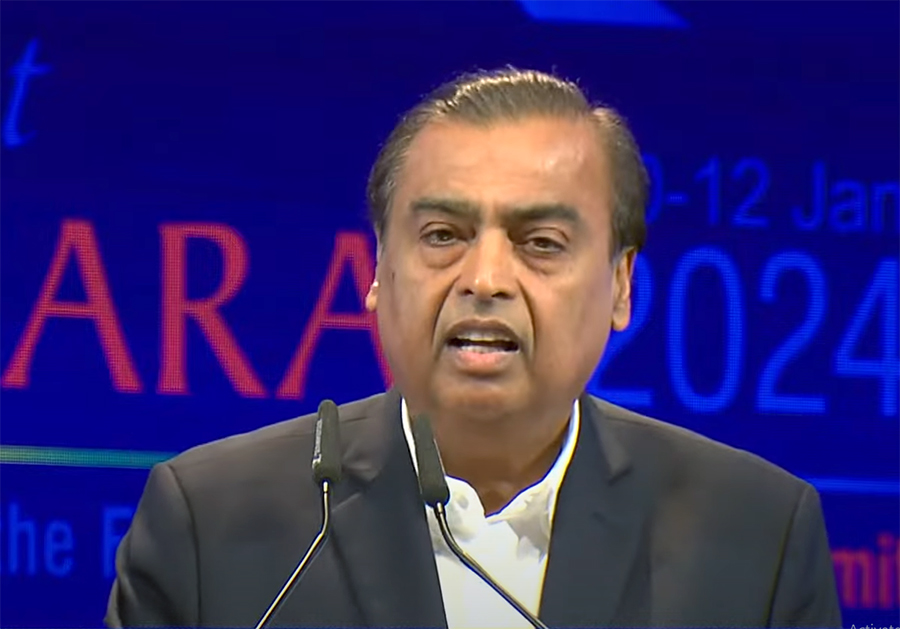

Mukesh Ambani, Chairman and Managing Director of Reliance Industries Limited, has been ranked first among all the Indians and second globally in the Brand Guardianship Index 2024 compiled by Brand Finance.

The Brand Guardianship Index is a global recognition of CEOs, who are building business value in a sustainable manner by balancing the needs of all stakeholders – employees, investors, and the wider society.

Notably, Mukesh Ambani was placed at the second position globally in the 2023 ranking as well.

This year Ambani was ranked at the first position in Brand Guardianship Index 2024 among the ‘Diversified’ conglomerates.

Ambani was ranked ahead of global majors like Satya Nadella of Microsoft, Google’s Sundar Pichai, Apple’s Tim Cook and Tesla’s Elon Musk, as well as fellow Indians such as N Chandrasekaran of Tata Group and Anish Shah of Mahindra Group, among many others.

Brand Finance’s survey gave Mukesh Ambani a BGI score of 80.3, just below 81.6 of Huateng Ma of China-based Tencent.

Brand Finance constructs a balanced scorecard of measures designed to identify the factors that best capture the ability of CEOs to act as stewards of their company’s brand and long-term value. This year’s analysis reveals that ESG has become the single most important driving force in determining CEO reputation.

Being regarded as ‘a sustainability champion’ accounts for 14 per cent of variation in reputation scores, ahead of factors such as perceived trustworthiness (12.5 per cent), having ‘a strong strategy and vision’ and global recognition.

According to Brand Finance, the role of a brand guardian is to build brand and business value. It is a global recognition of the CEOs, who forge win-win partnerships to build a sustainable future, redefining the role of a CEO from ultracompetitive entrepreneur to collaborative diplomat. The Brand Guardianship Index celebrates the CEOs, who balance the needs of commercial success, long-term brand building and personal reputation management.

ALSO READ: Apple Q4 Revenue up 6%