Mehrotra emphasised the importance of semiconductors in daily life, noting their integral role in powering technologies that impact society…reports Asian Lite News

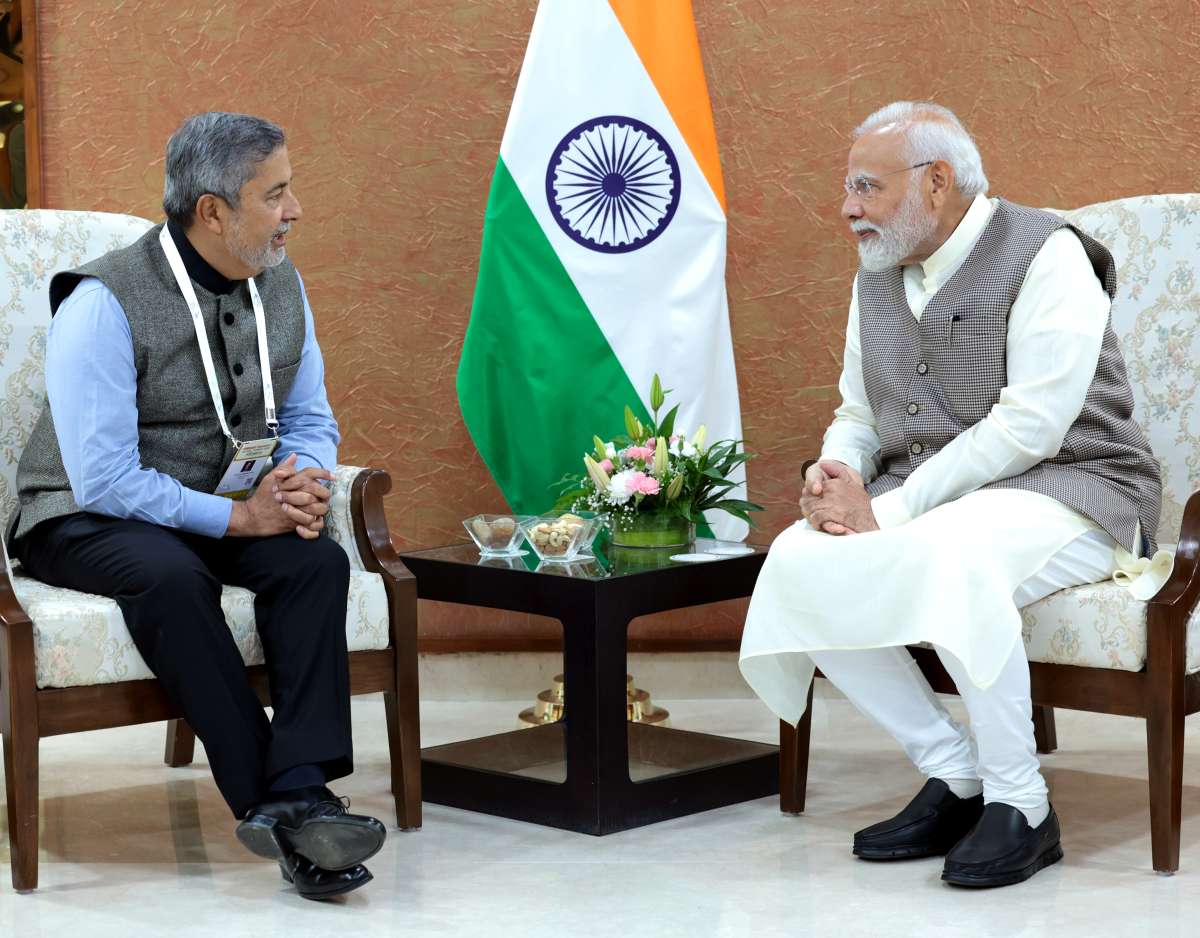

On the second day of the Vibrant Gujarat Global Summit, Sanjay Mehrotra, CEO of Micron Technology, underscored the pivotal role of semiconductors in India’s growth and the global economy.

Speaking at the event, Mehrotra highlighted the significance of Vibrant Gujarat as a forward-looking forum to discuss visionary ideas crucial for India’s semiconductor prowess and overall development.

“Vibrant Gujarat is an important forward-looking forum to discuss the visionary ideas critical for India, its growth, its semiconductor power. Never has the opportunity been greater, and I think we can feel it in the Vibrant Gujarat event,” remarked Sanjay Mehrotra, acknowledging the significance of the summit as a platform for discussions that shape the future.

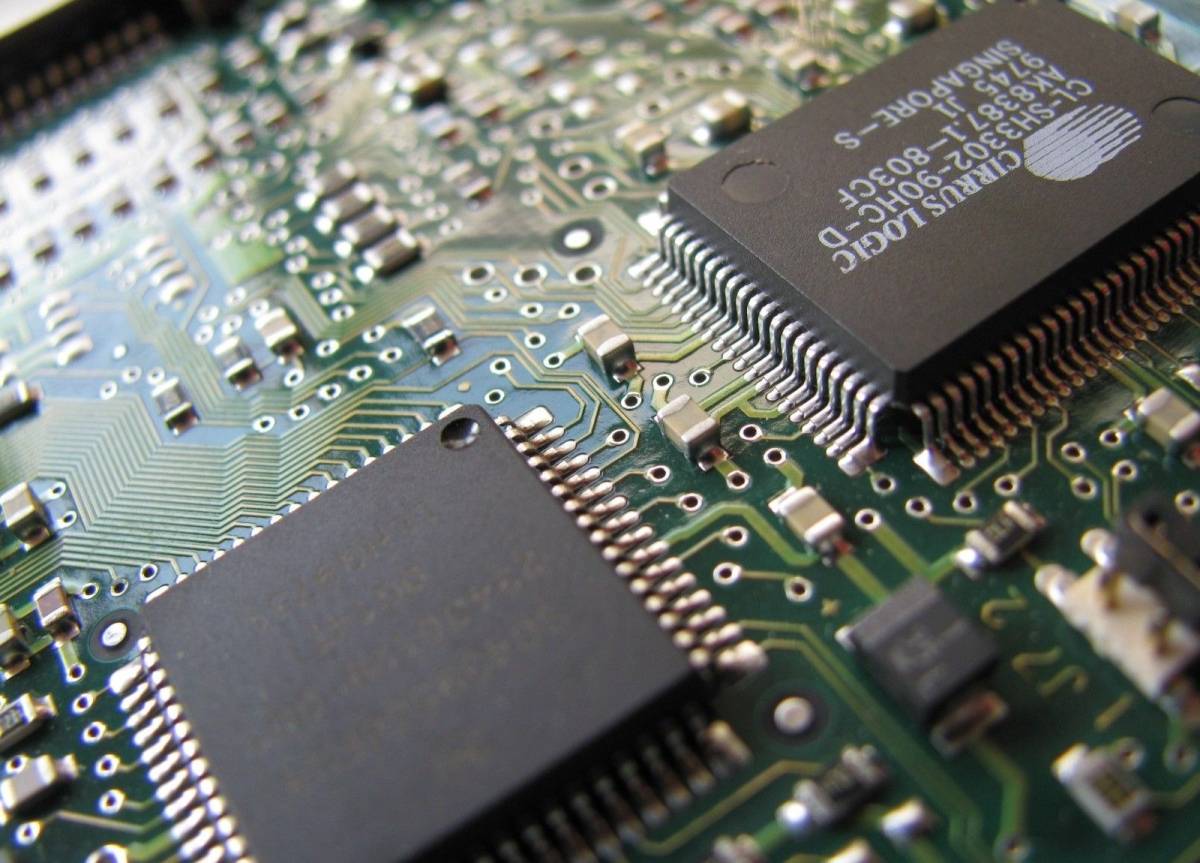

Throughout the world, semiconductors have become central to almost every economic discussion, reflecting their critical role in various industries.

Mehrotra emphasised the importance of semiconductors in daily life, noting their integral role in powering technologies that impact society.

“The global semiconductor industry is poised to surpass 1 trillion dollars. The semiconductors we build at Micron, memory chips, handle the data that makes computing valuable,” explained Mehrotra.

His remarks shed light on the substantial economic value and impact of semiconductors, positioning them as a driving force behind technological advancements and innovation.

The CEO’s insights resonated with the growing global awareness of the strategic importance of semiconductors.

As countries strive to advance their technological capabilities, semiconductors play a crucial role in powering a wide range of applications, from computing and communication to healthcare and artificial intelligence.

Sanjay Mehrotra’s participation in the Vibrant Gujarat Global Summit not only underscores Micron Technology’s commitment to India but also reflects the broader recognition of the semiconductor industry’s pivotal role in shaping the future.

On Tuesday, Mehrotra had updated PM Modi on the progress of Micron’s project in Sanand, Gujarat, expressing gratitude for the state and central-level support. Acknowledging India’s potential in semiconductor manufacturing, Mehrotra outlined the critical role the country could play in this industry. Micron Technology, a key semiconductor manufacturer, had previously announced an investment of up to $825 million for a semiconductor assembly and test facility in India.

The summit continues to provide a platform for leaders, experts, and businesses to engage in discussions that contribute to India’s technological advancement and economic growth. (ANI)

ALSO READ-Chip giant Micron sets eyes on India